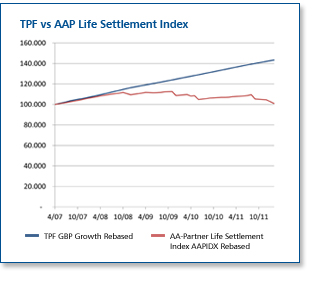

| Traded Policies Fund MPL has a proven track record, as Manager of the Traded Policies Fund, for excellent performance of a fund that invests in Traded Life Policies (TLPs)(1). TLPs, or life settlements are US-issued whole of life insurance policies sold before maturity so that the original owners can enjoy some of the benefits of their TLP in their own lifetimes. Buyers of such TLPs become the beneficiary and continue paying premiums until the TLP matures.  The Traded Policies Fund is a specialist investment fund that allows investors to participate in the excellent returns achievable from investing in a portfolio of Traded Life Policies ("TLPs"). TLPs are US-issued Life Assurance or Life Settlement policies that have been sold prior to maturity date. The Traded Policies Fund is a specialist investment fund that allows investors to participate in the excellent returns achievable from investing in a portfolio of Traded Life Policies ("TLPs"). TLPs are US-issued Life Assurance or Life Settlement policies that have been sold prior to maturity date.MPL's Traded Policies Fund applies its shrewd and rigorous investment process in order to target steady, incremental annual returns of between 8-10% after charges year in, year out. MPL manages the Fund so that investment risk is managed to ensure that high potential growth is achievable.  This can only be achieved with prudent actuarial analysis. It is important to note TLPs are not without risk because while it is known on day one how much money they will eventually pay out, it is not known exactly when each TLP will mature and how many premiums will need to be paid beforehand. Therefore to buy just one or just a few TLPs would be a speculative exercise that would pay out huge dividends if the TLPs paid out quite quickly, but the return could be quite low if a longer period of time were to elapse before the TLP matures. Furthermore, MPL's Traded Policies Fund holds TLPs sourced from and issued by a broad number of counterparties(2) to reduce risk even further. This can only be achieved with prudent actuarial analysis. It is important to note TLPs are not without risk because while it is known on day one how much money they will eventually pay out, it is not known exactly when each TLP will mature and how many premiums will need to be paid beforehand. Therefore to buy just one or just a few TLPs would be a speculative exercise that would pay out huge dividends if the TLPs paid out quite quickly, but the return could be quite low if a longer period of time were to elapse before the TLP matures. Furthermore, MPL's Traded Policies Fund holds TLPs sourced from and issued by a broad number of counterparties(2) to reduce risk even further.MPL has addressed the risk factors to dramatically reduce them by smart investment management that in turn creates predictable returns, as seen in the performance history of the Fund. The TLPs in the Fund are valued on a monthly basis by use of an actuarial model that aims to equitably unwind the growth of the TLPs, making adjustments for claims experience and future premium liabilities. The result is an extremely smooth and predictable growth trend that can be seen from the Traded Policies Fund's past investment performance. Furthermore, these returns are uncorrelated with other main asset classes such as equities, bonds and property. This kind of performance is incredibly attractive to the many investors who suffered in the financial crisis. That made investors realise the dangers that go hand in hand with investing in traditional equities and bonds. They now want alternatives with predictable returns. It is the reason why MPL is now working with a growing number of institutions and distributors around the world, including some household names that put investment strength at the top of their requirements. To meet this demand the Traded Policies Fund is available in share classes denominated in a variety of currencies, including Sterling, US Dollar, Euro, Swiss Franc, Yen, Swedish Krona and Malaysian Ringitt. This adds another kind of risk – currency exposure – but MPL is adept at handling this risk too with the use of currency hedging. For further information, please visit www.tradedpoliciesfund.com. (1) The graph above shows the sterling share class of TPF has outperformed the AAP Life Settlement Index since the index launched in 2007.

|

||||||||||||||||||||||||||||||||||||||||||||